Housing Data

- Existing Home Sales (closed deals in Sep) rose 3.2% to an annual seasonally adjusted pace of 5,470,000 units. Single Family sales rose 4.1% to 4,860,000 with a median price of $235,700 - up 5.6% in the last year. Condo sales actually fell 3.2% to 610,000 units with a median price of $222,100, which is up 6.1% from a year ago. Who's buying - 34% 1st time buyers, 21% cash buyers, and 14% investors (65% paid cash). Average time on the market is 39 days with a 4.5 month supply of homes for sale.

- Pending Home Sales Index (signed contracts in Sep) rose 1.5% (1.2 expected) to 110.0. The West region was up 4.7%, South up 1.9%, Midwest down 0.2%, and Northeast down 1.9%.

- New Home Sales (signed contracts in Sep) rose 3.1% to a seasonally adjusted annual pace of 593,000 units in September. The median price of a new single family home is now $313,500 with a mean price of $377,700. There are now 235,000 new homes for sale.

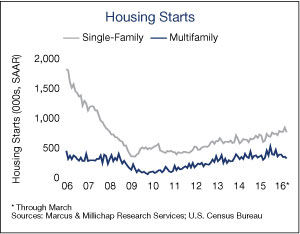

- Housing Starts (excavation began in Sep) plunged 9.0% to a seasonally adjusted annual rate of 1,050,000 units. Multi-family Starts (5 units or more) fell a whopping 39% to 250,000 units per year. The good news is that Single Family Starts rose 8.1% to 783,000 units. Builders typically hurry to pour foundations before the cold winter months and in preparation for the Spring buying season.

- Building permits rose 6.3% to a seasonally adjusted rate of 1,225,000 units. Single Family Permits increased 0.4% to an annual rate of 739,000 units. Multi Family Permits rose 17.2% to 449,000 units per year.

- Remember that New Home Sales, Housing Starts, and Building Permits, are notoriously volatile and are exacerbated by the constant revisions and changes to the seasonal adjustment formula. These numbers typically have a high degree of statistical uncertainty.

- The S&P CoreLogic Case Shiller 20 City Composite HPI rose 0.24% in August (as expected) and 5.1% for the last 12 months. Price increases were led by Portland, Seattle, and Denver.

- The FHFA Home Price Index rose 0.7% in August (0.4% expected) and 6.4% for the last 12 months.

- With this latest increase, the estimated value of homes in America is about $22 Trillion - that's $22,000,000,000,000. Generally, homeowners like rising home prices as it increases wealth but it also creates problems for home buyers. Buyers are frustrated with low inventory and the choices of affordable homes - or worse - being priced out of the market completely.

Today's blog courtesy of Cheryl Taylor, American Pacific Lending